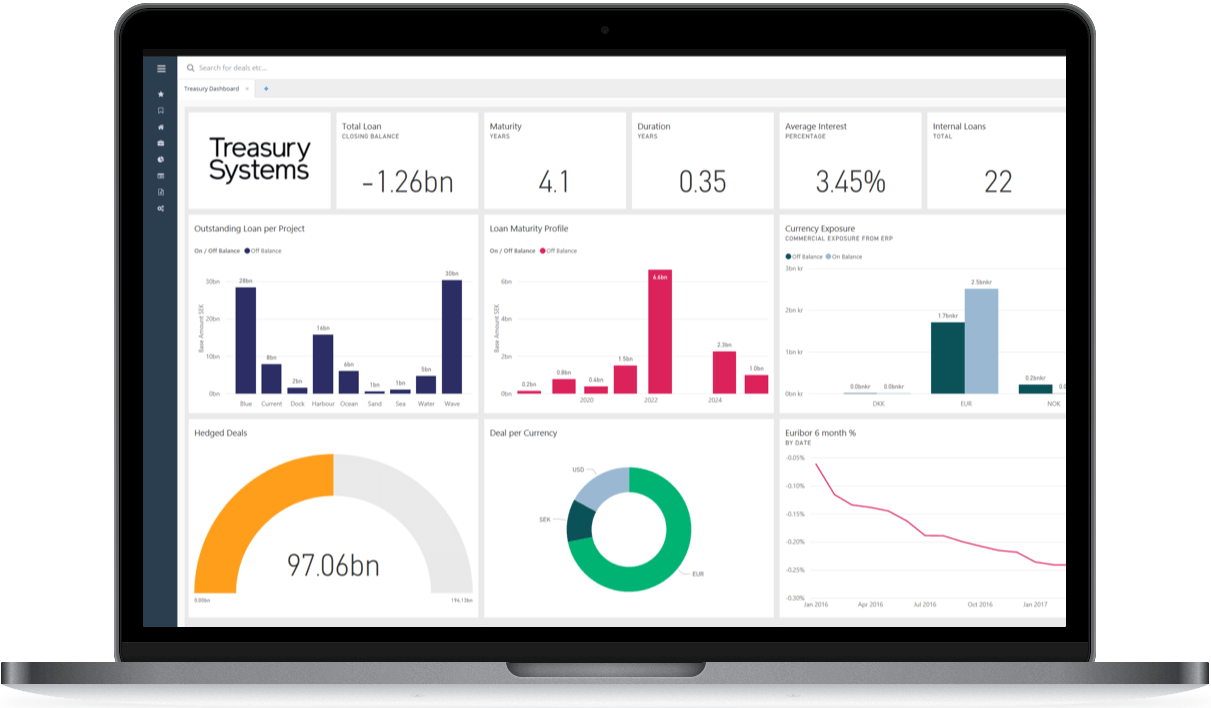

We have been hard at work during the summer months releasing some exciting new features as well as some great improvements on existing features in TS. We wanted to highlight a few of them to you.

We encourage you to sign up for the Product Release webinar where we will demonstrate these new features live.

NEW

FRONT OFFICE

Introducing

Deal suggestions

IMPROVED

FRONT OFFICE

Bonds 2.0

- Better overview of transactions in bond deals

- Add fees to each bond deal

- New permissions for bond definitions

NEW

AUTOMATION

Introducing

Deal upload

We are happy to introduce the possibility to upload internal FX requests to 360T for execution of the external deal and for pricing of the internal deal. With the new “Upload request rules” you can decide precisely which deals should be uploaded.

There is a new activity available in the Autopilot allowing you to schedule the upload process at your convenience. This feature also bring a couple of new reporting columns “Upload deal status” and “Request status” that signals if they will be sent automatically and if they have been sent to the trading station.

We are starting with support for 360T and will add more trading platforms in the coming months.

![]()

NEW

AUTOMATION

Introducing

Activities dashboard

NEW

REPORTING

Accounting in Reports

All accounting information can now be extracted in Reports. It works the same way as any other report and we have introduced a new report type – Accounting report. It add more flexibility to sort and add information regarding Counterparty and all configured dimensions. It is also possible to do a quick export to excel to get a clean Excel file to facilitate easier reconciliation with your ERP-system.

Report columns available:

- Global ID

- Deal ID

- Account (general ledger)

- Original amount

- Accounting amount

- FX rate accounting booking rate

- Dimensions (counterparty & dimension)

- Coding text (amount type)

- Accounting Status

- Debit / Credit

- Event time & reversal (Realised, Unrealised, Reversal)

- Due date (payment date, maturity date month end date), accounting date.

- Accounting currency

- Legal entity

- Report date

- Period (start date & end date for report)

- Deal Type (Accounting Program)

NEW

REPORTING

FX Risk scenarios

Introducing the possibility to add FX Risk scenarios that can easily be applied in reports. Start by adding a couple of scenarios by giving them a name and a color. Then define what percentage level shift in you expect for each scenario. Once in the report TS will display the Net and Absolute risk per currency based on the defined risk scenario and also the corresponding color in the report to improve visibility.

Sign up for the webinar below

Let us show you how you can spend less time managing more operations with the new features.

Want to know more?

Feel free to request a demo.

Or give us a call at +46 (8) 660 88 30

Treasury since 1984

Treasury Systems was founded in 1984 under the name of Currency Risk Management. Our latest system has been innovated through experience and is the result of a close relationship with our partners.